Strong start for Annexin in 2024

Annexin Pharmaceuticals had a successful 2023, and the new year seems to be starting with continued success. Positive signals of effect have been observed in the majority of patients treated in the phase II study in retinal vein occlusion, and the company’s preclinical cancer research has also produced promising results. Additionally, the company emerged strengthened from an oversubscribed rights issue that added SEK 35.6 million at the turn of the year. BioStock reached out to CEO Anders Haegerstrand for a comment.

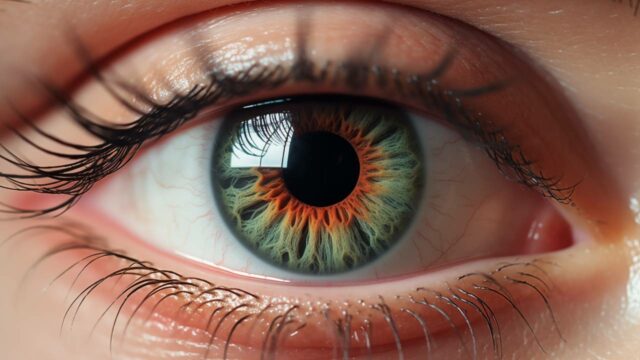

Annexin Pharmaceuticals focuses on the vascular disease retinal vein occlusion (RVO), which occurs due to a blood clot in the retina’s vein, leading to impaired vision and sometimes blindness. With the biological drug candidate ANXV, the company aims to develop a new type of treatment with fewer side effects than current options, addressing the underlying cause by reducing the stickiness of red blood cells, which is believed to contribute to the disease.

The candidate is being evaluated in a phase II study in the USA, with an expected readout in mid-2024. Additionally, activities are underway in the cancer field where ANXV may fill a medical gap in the current treatment.

More promising signals in the RVO study

Annexin took many important steps forward in 2023, which have continued this year. In the ongoing clinical phase II study, patients diagnosed with RVO and not yet receiving standard anti-VEGF therapy are treated with ANXV. So far, the observed results are positive. On February 8, 2024, the company announced that six out of eight patients showed improvements or no deterioration, in visual acuity and reduced retinal swelling after ANXV treatment.

In a comment on the promising results, Anders Haegerstrand, CEO of Annexin Pharmaceuticals, stated:

“We are very pleased with these new observations that confirm our previously reported findings and our expectation that ANXV can have clinically meaningful and lasting effects on visual acuity and reduce the need for unwanted drug injections directly into the eye. We are approaching the timepoint where we can plan for further clinical studies based on additional promising clinical data. Activities to find a license partner are ongoing and I am convinced that today’s update will generate increased interest.”

The company’s Co-founder and CMO, Dr Anna Frostegård, believes there is every reason to be optimistic, and these data provide important information and guidance for an upcoming phase IIb study. The results follow the previously reported positive signals in August 2023. Up to 16 patients are expected to receive treatment. Read more here (September 2023).

Progress in oncology projects

Annexin has also made progress in its cancer projects. To harness ANXV’s immunostimulating properties, a concrete plan has been made for patient selection and clinical study design. For the second cancer initiative, the company has successfully created an ANXV conjugate – meaning it is bound to chemotherapy – that has shown promising results in preclinical tests in triple-negative breast cancer. This could enable more effective treatment compared to existing alternatives. Read more here.

Increased interest from potential partners

Annexin is actively seeking licensing partners in ophthalmology and oncology. According to the company, interest from potential collaborators has increased, especially after the company’s presence at JP Morgan’s annual Healthcare conference. The company hopes that results from ongoing studies and strong data will enhance opportunities for future licensing agreements. During the spring, the company will present its projects and data at several conferences in the USA.

Another notable aspect of the year is the rights issue that Annexin conducted in December. In a challenging financing climate, the financing round was subscribed to 127.1 per cent. The capital injection of SEK 35.6 million enables the company to advance the candidate ANXV towards upcoming significant milestones, especially regarding the phase II study in RVO.

At the turn of the year, the cash amounted to just over SEK 21.4 million. Annexin has also secured a new bridge loan from major shareholders of SEK 15 million, meaning Annexin has funding for operations through Q2 2024, while exploring alternatives to strengthen long-term financing.

In a comment to BioStock, CEO Anders Haegerstrand said:

“With the promising results in our studies, we see increased interest from potential collaboration partners, which, combined, provides good conditions to secure future financing.”

The content of BioStock’s news and analyses is independent but the work of BioStock is to a certain degree financed by life science companies. The above article concerns a company from which BioStock has received financing.