Redsense Medical aces Q1

Following the overwhelming upswing in sales during the fall of 2019, the market had high anticipations for Redsense Medical’s start of 2020. Yesterday, the company’s Q1 report exceeded all expectations when reporting a 154 per cent increase in sales compared to the same period last year – 5,0 MSEK compared to 1,96 MSEK – the first quarter with a reported net-profit in the company’s history.

A good product is the basis for good sales

In a previous interview with BioStock, CEO Patrik Byhmer told us about the growing knowledge of the risks of potentially fatal blood loss during dialysis treatment. With the increased awareness comes a jump in demand for products that lower the risk, which is exactly what Redsense Medical’s primary product Redsense does.

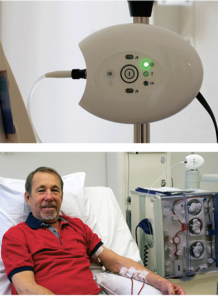

The Redsense blood loss detection solution is designed to detect blood leakage through core technology utilizing fiber optics. The device monitors for potential blood loss from the hemodialysis access site in hemodialysis patients undergoing hemodialysis treatment. The device includes a blood sensor incorporated into a sensor patch. The sensor monitors potential blood leakage from the venous needle blood access via a light signal and will alarm if a blood leakage is detected.

Exceeded high expectations

Perhaps the Q1 results should not come as a surprise. In 2019, Redsense Medical could report 59 per cent growth, primarily due to an increased demand in the US – the company’s main market. Due to the jump in demand, Redsense Medical had to double its production capacity, and it took the opportunity to ensure that the capacity could be doubled once more if the need arose. The company also built a reliable and responsive supply chain to meet the increasing demand.

To this background, Redsense Medical was ready to make delivery on all orders during the first quarter of 2020.

Strong start of the year

Something that pushed the high expectations on the Q1 results even higher was the unusually strong start of the year. Already in January, the company could report incoming orders of a value exceeding 2 MSEK, with a single order worth more than 1,5 MSEK. The January sales numbers were comparable to the total sales in Q1 in 2019. With that in mind, it was fairly clear that the company would outperform their Q1 results from previous years.

However, at the time, no one had predicted the Covid-19 pandemic to happen and turn the world upside down. So how has the virus outbreak impacted Redsense Medical?

The pandemic has limited effects on company operations

In March, Redsense Medical announced that operations continued without significant impact of Covid-19, at least in the US, the company´s largest market. The company’s well-established local organization in the US provides a resilience against the imposed travel restrictions. Nevertheless, it is mainly the logistics and product supply that have an influence on sales according to the company, and they have seen shipment times increase by 5-6 weeks. To soften such implications, Redsense Medical have pre-ordered the estimated material requirement to secure company operations for the upcoming 4-6 months.

The company also raised a flag regarding their end customers – hospitals and clinics – who are put on a heavy strain by Covid-19, which may eventually impact their placing of orders. Furthermore, the European isolation rules prevent distributors from performing demonstrations and evaluations in clinics. Put together, the full impact of Covid-19 may yet to be seen.

A trend of increased home dialysis

With that said, dialysis is a necessary substitute when the kidneys are unable to purify the blood from toxic residues and the life-supporting treatment requires regular sessions. The most common type, hemodialysis, is generally performed at least three times a week. Given these facts, dialysis is not likely to become less frequent even if the health care system is strained.

Instead, there has been speculation regarding whether the pandemic could boost the development towards more home-based dialyses, not least in the US. With home dialysis, the need for leakage control is even greater than in a hospital setting, as medical assistance is unavailable, and a blood leakage alarm is thus a requirement, which aligns well with Redsense Medical’s business case.

Even before the pandemic, there was a trend of increased home dialysis on the US market. This was further accelerated by last year’s executive order from President Donald Trump aimed at promoting the use of dialysis in the home. During the ongoing Covid-19 pandemic, dialysis patients, who have weakened immune systems, must maintain social distancing and avoid exposure to the virus. In the backdrop of Covid-19, the push for home dialysis in the US is taking on a new urgency and shedding light on the incentives to switch from out- and inpatient facilities.

Covid-19 could boost Redsense sales

Covid-19 could boost Redsense sales

For Redsense Medical, the trend towards more home dialyses has been the main driver of growth during the last year, particularly in the US, where the Redsense device is the only anti-leakage product with an FDA approval. The current situation thus presents an interesting opportunity for further growth as it underlines the advantages of home dialysis for this vulnerable group.

In other words, the pandemic might actually have the reversed effect for Redsense Medical compared to many companies in the life science sector and other areas. It will be interesting to see how soon this trend will be visible in the company’s sales numbers.

Positive future prospects

In a previous interview with CEO Patrik Byhmer, albeit from before the Covid-19 pandemic, he stated that the key factor for future success for Redsense Medical would be the growth on the US market. Although starting the year off strong, the current situation is a risk factor as to the timing of reaching the expected growth target, while all other parameters point in the same direction; the Redsense device is approved by the FDA and is swiftly becoming part of standard dialysis in the US, alongside the trend toward more home dialyses. Byhmer also expected the European sales to take off in the near future, a prognosis that might be pushed slightly further down the line by the Covid-19 pandemic.

Entering the rest of the year with liquid assets – cash and cash equivalents – just short of 10 MSEK, however, gives the company a solid base to build on. The fact that Redsense Medical is now making a net-profit further strengthens the company’s position going forward.

Entering the rest of the year with liquid assets – cash and cash equivalents – just short of 10 MSEK, however, gives the company a solid base to build on. The fact that Redsense Medical is now making a net-profit further strengthens the company’s position going forward.

In the CEO comment of the report, Patrik Byhmer emphasizes that the first quarter of the year has historically been the weakest, which brings hope to a continued net-profit streak. He also underlined that the company expects to continue to see sales numbers that surpass the preceding years.

As expected, the market had a positive reaction to the report and the stock price jumped 14 percent at opening. Given yesterday’s general market decline, however, the share finished the day at 14.60 SEK, i.e. an increase of 4.29 percent, after a peak of 15.95 SEK. To follow up on the extraordinary report, BioStock has invited Patrik Byhmer, CEO of Redsense Medical, to its studio later this week for a video interview. Stay tuned to learn more about the company achievements and their outlook for the rest of the year.

The content of BioStock’s news and analyses is independent but the work of BioStock is to a certain degree financed by life science companies. The above article concerns a company from which BioStock has received financing.